Be warned, a new scam attempting to take advantage of tax time is making the rounds.

Fraudulent TEXT MESSAGES are appearing on phones across Canada.

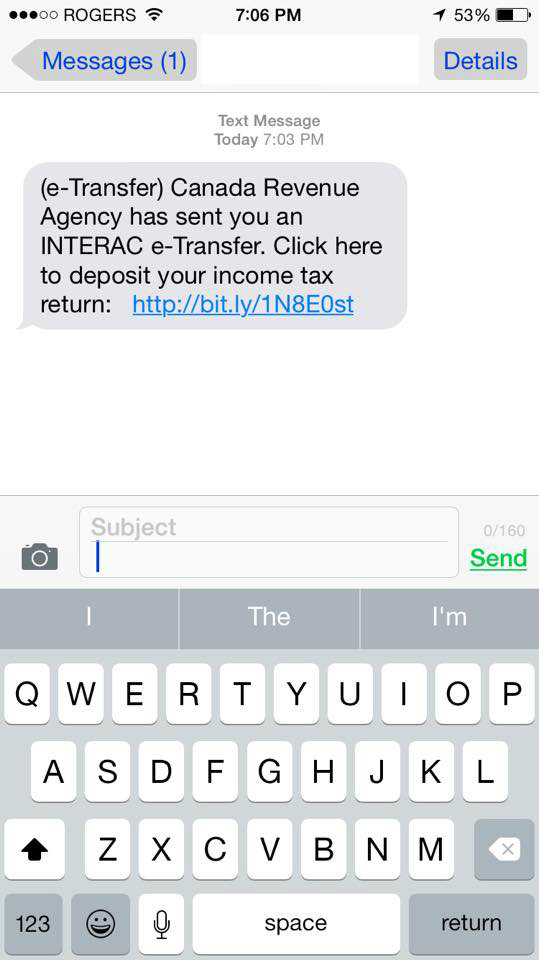

The message appear like the following:

CRA Text Message

CRA does NOT communicate to you via text message and will only send payments by direct deposit or by cheque, never by email money transfer.

Read more from CRA:

http://www.cra-arc.gc.ca/ntcs/bwr-eng.html

Read more from CTVNews.ca:

http://bc.ctvnews.ca/revenue-canada-td-bank-warn-of-text-scams-1.2294962

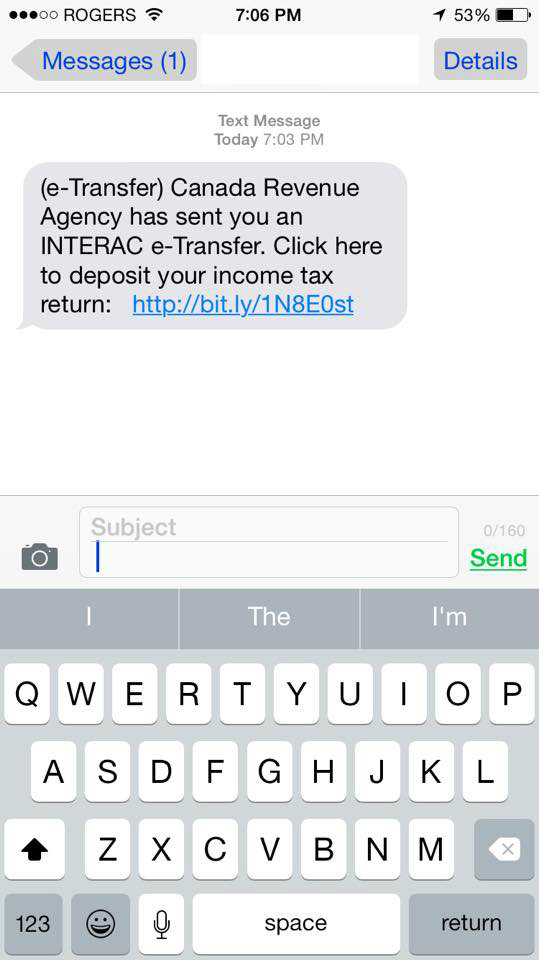

Should you click on the link provided in the text (not advised), your security system SHOULD present you with the following:

Stop

Stop - there might be a problem with the requested link

The link you requested has been identified by bitly as being potentially problematic. This could be because a bitly user has reported a problem, a black-list service reported a problem, because the link has been shortened more than once, or because we have detected potentially malicious content. This may be a problem because:

Some URL-shorteners re-use their links, so bitly can't guarantee the validity of this link.

Some URL-shorteners allow their links to be edited, so bitly can't tell where this link will lead you.

Spam and malware is very often propagated by exploiting these loopholes, neither of which bitly allows for.

The link you requested may contain inappropriate content, or even spam or malicious code that could be downloaded to your computer without your consent, or may be a forgery or imitation of another website, designed to trick users into sharing personal or financial information.

If it does not, you may want to consider upgrading your security system.

Related Articles:

Fraud Alert: Fraudulent Emails from Canada Revenue Agency